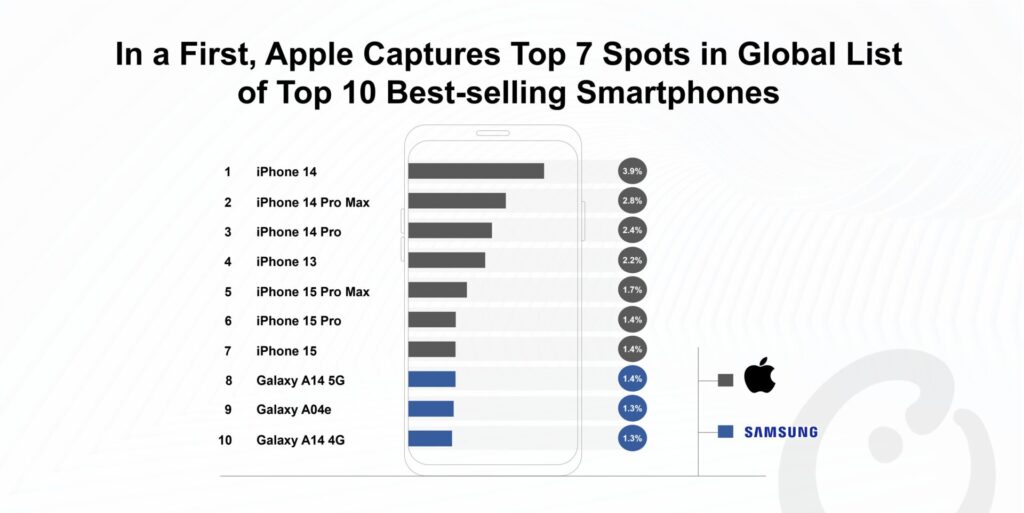

Apple Dominates Global Smartphone Sales, Securing 7 of Top 10 Spots. In an unprecedented display of market dominance, seven out of the top ten best-selling smartphones globally now bear the Apple insignia, marking a significant achievement that surpasses the brand’s previous stronghold in 2022. This remarkable feat underscores the brand’s overwhelming presence in the global smartphone arena, almost completely monopolizing the top ranks in sales.

Apple Elevates iPhone 15 Battery Performance Expectations

Reflecting on historical data, this level of dominance recalls the brand’s impressive performance in 2022 when eight out of ten of the world’s best-selling models were from the same manufacturer. However, the latest figures suggest an even stronger market position, with the only non-Apple model in the top ranks previously being the Samsung Galaxy A13.

The latest annual report from Counterpoint Research sheds light on the evolving dynamics of the smartphone market, revealing that the combined market share of the leading smartphone manufacturers reached an all-time high of 20% in 2023, up from 19% the previous year. This growth is indicative of the increasing concentration of market power within the top brands.

In the year 2023, the flagship model from this leading brand emerged as the year’s top seller, capturing 19% of the brand’s total sales, albeit a slight decrease from the 28% share held by its predecessor in 2022. The subsequent models from the same brand also secured the 5th, 6th, and 7th positions, with the pro version of their latest release being hailed as a “top seller” in the final quarter of the year.

The enduring popularity of the previous year’s model, particularly in markets such as Japan and India, has been bolstered by promotional activities, securing its fourth-place ranking consistently into 2023. This trend is reflective of strategic market penetrations and the brand’s ability to maintain relevance across its product lines.

Despite a general leveling off in sales for 2023, promising signs for 2024 are emerging from India, where the latest model has matched the performance of its predecessor, indicating a sustained consumer interest and brand loyalty.

Looking ahead, Counterpoint Research anticipates a reshuffling in the top ten rankings for 2024, with Chinese brands expected to make a significant entry. Moreover, a shift towards models equipped with integrated 5G technology is predicted to redefine the competitive landscape.

Meanwhile, IDC’s analysis highlights a 5.5% decline in overall smartphone sales in China between 2022 and 2023, with the leading brand experiencing a comparatively smaller decline of 2.2%. This resilience further cements the brand’s strong positioning, not just globally but also within key markets, reinforcing its status as a dominant force in the smartphone industry.