Apple Card savings accounts exceed $10 billion. US users of the Apple Card credit card have deposited more than $10 billion into Apple savings accounts introduced on April 17 in partnership with Goldman Sachs.

Apple Vision Pro labs are underbooked

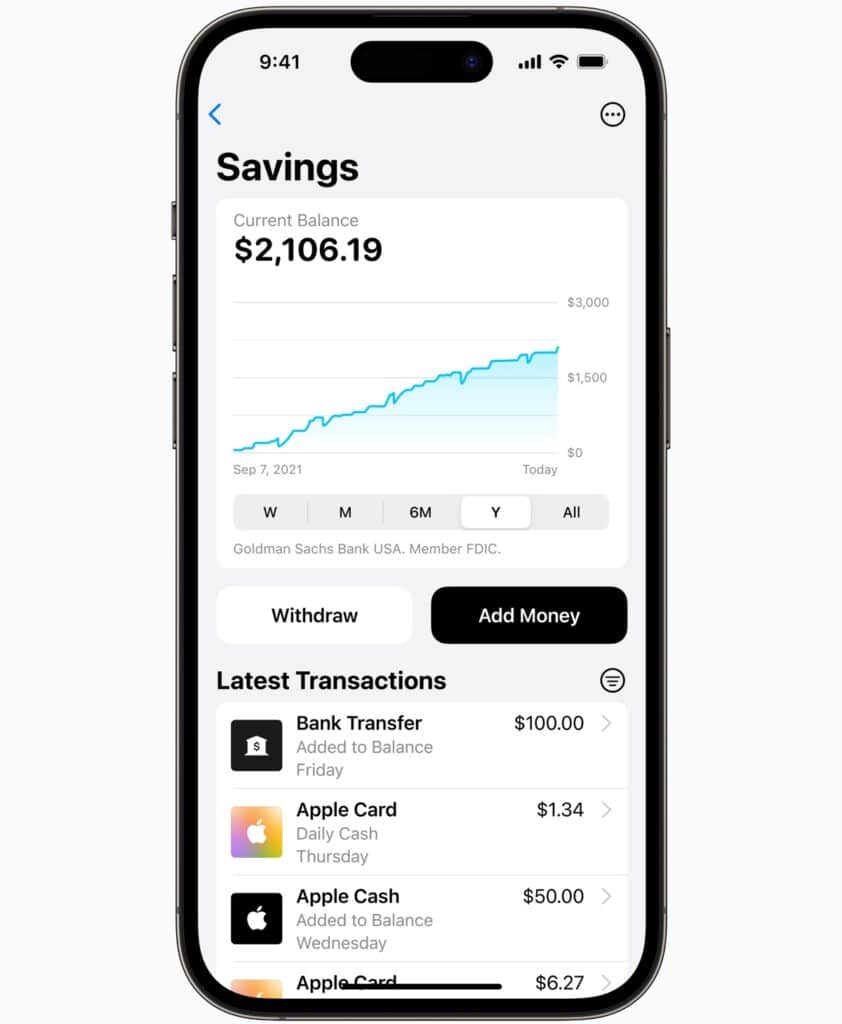

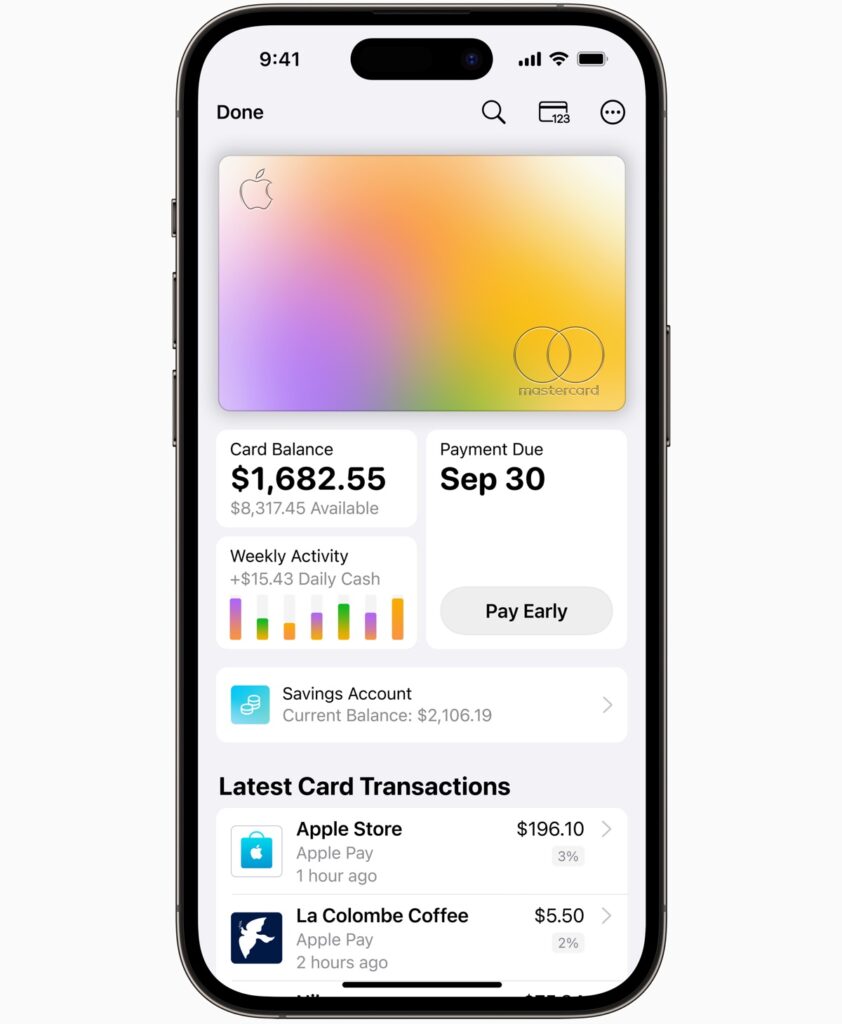

In the first Apple savings account, users can automatically send refunds obtained by making purchases with Apple Card, in this way you get an interest rate of 4.15%. In addition to repayments from Apple Card, users who wish can transfer money from other banks’ checking accounts to their Apple savings account.

With the launch in April, the 10 billion dollar threshold was reached in just over three months: Apple points out that 97% of users who have opened a savings account have chosen to automatically load daily repayments.

The basis of success is the extreme ease of opening an account, a few taps in Wallet on the iPhone for those who already have an Apple Card credit card, as well as an interest rate on savings that is significantly higher than the market average and compared to what is offered by traditional and online banks in the USA and beyond.

In addition, there are no constraints or extra costs for users, as pointed out by Jennifer Bailey, Apple’s vice president for Apple Pay and Apple Wallet:

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with the financial health of our users in mind. That was our goal with the launch of Apple Card four years ago, and it has remained our guiding principle with the launch of Apple Savings.”

“With no fees, minimum deposits and minimum balance requirements, Savings offers users an easy way to save money every day and we are thrilled to see the excellent reception from both new and existing customers.”

Goldman Sachs also celebrates the milestone achieved, as stated by Liz Martin, head of Enterprise Partnerships at Goldman Sachs:

“We are very pleased with the success of the Savings Account as we continue to deliver seamless and valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead financial lives. healthier”.

So far the official developments and successes, but already since January voices of discontent have been leaking in Goldman Sachs for the collaboration with Apple due to the high cost incurred first for Apple Card and now also for savings accounts.

The investment bank appears to be planning to completely abandon end-user products and services, but is struggling to find a buyer to take over the credit card business, including Apple Card. The rumors suggest negotiations are underway with American Express.